MicroStrategy Bolsters Bitcoin Holdings with $1.1B Investment

Introduction

MicroStrategy, a leading business intelligence firm, has once again made headlines by investing nearly $1.1 billion in Bitcoin, adding over 10,000 BTC to its already substantial crypto reserves. This move underscores the company’s ongoing commitment to Bitcoin as a cornerstone of its treasury strategy.

The Latest Bitcoin Acquisition

-

Scale of Investment Between January 21 and January 26, MicroStrategy acquired 10,107 BTC at an average price of $105,596, bringing its total Bitcoin holdings to 471,107 BTC, valued at over $30.4 billion.

-

Funding the Purchase This purchase was funded through the issuance and sale of over 2.765 million shares, highlighting MicroStrategy’s aggressive approach to capitalizing on perceived opportunities in the Bitcoin market.

Performance and Market Context

-

BTC Yield and Profits MicroStrategy reported a Bitcoin yield of 2.90% year-to-date in 2025, with an unrealized gain of over $19 billion on its Bitcoin investments, showcasing the profitability of their strategy thus far.

-

Market Reaction and Criticism The market has responded variably to MicroStrategy’s strategy. While some applaud the company’s foresight, critics like Peter Schiff warn of potential losses if Bitcoin’s price does not continue to rise above the average purchase price of MicroStrategy’s holdings.

Strategic Implications

-

Leadership in Corporate Bitcoin Adoption With this latest acquisition, MicroStrategy solidifies its position as the largest corporate holder of Bitcoin, setting a trend for other companies to consider digital assets as part of their treasury reserves.

-

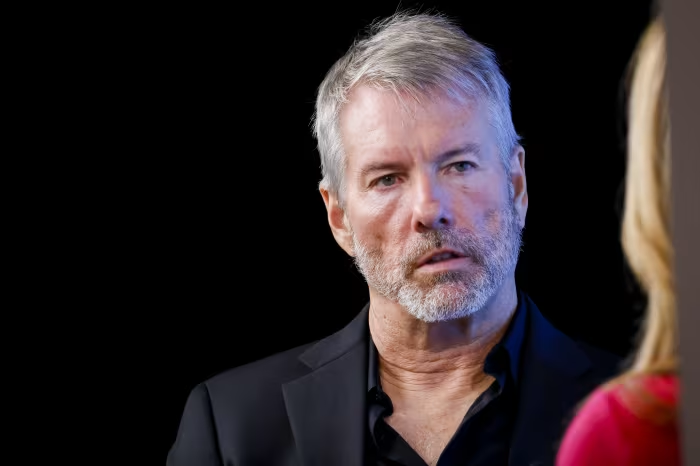

Future Plans Michael Saylor, the company’s founder, has hinted at further acquisitions, suggesting that MicroStrategy’s Bitcoin strategy is far from complete.

Risks and Considerations

-

Debt and Equity Financing The company’s strategy of raising capital through debt and equity to purchase Bitcoin raises questions about sustainability, especially if Bitcoin’s price experiences significant volatility or decline.

-

Investor Sentiment The debate continues among investors about whether buying MicroStrategy shares is the best way to gain Bitcoin exposure, with some arguing direct Bitcoin investment might be more efficient or less risky.

Looking Ahead

-

Market Influence MicroStrategy’s actions could influence Bitcoin’s market dynamics, particularly if more firms follow suit in adopting similar treasury strategies.

-

Regulatory Scrutiny As MicroStrategy’s Bitcoin reserves grow, so does the potential for increased regulatory attention, which could impact future strategies.

Conclusion

MicroStrategy’s latest $1.1 billion investment in Bitcoin marks another bold step in its journey towards becoming a de facto Bitcoin investment vehicle. While it has yielded significant unrealized gains, the strategy carries inherent risks tied to cryptocurrency volatility and the broader market’s reception to such an unconventional corporate finance approach. This move not only affects MicroStrategy’s balance sheet but also signals to the market the growing integration of Bitcoin into corporate financial planning.